Key points

- 2023 was a year of extreme volatility and uncertainty. Central banks around the world confirmed a commitment to higher interest rates due to inflation concerns.

- 2024 is likely more of the same with increasing concern around slowing economic growth and risk of a recession. A new economic cycle maybe on the horizon.

- Keeping focused on the key principles for successful investing is critical more now than ever and we thought it timely to remind you of this.

Yearly wrap up

With the year coming to a close, we thought it timely to write to you summarising 2023 and looking forward to what could be on the horizon for 2024.

At the same time last year, we wrote and forewarned that financial markets would be especially volatile over the next 12 months. This turned out to be spot on, contributed to by several influences - War in Europe, a worldwide problem of inflation resulting in higher interest rates for longer than anyone thought, resulting in slowing economic growth worldwide. With all of this extreme volatility, we understand that it can be difficult to hold our nerve and continue to take a long-term approach. We acknowledge and appreciate your steadfast commitment to staying the course.

Looking forward to 2024, and for the same reasons as 2023, we see continued high levels of volatility in share markets. However, once higher interest rates take full effect and significantly slow the economy further, we expect the Reserve Bank will be forced to reduce interest rates, starting a new economic cycle. This should stimulate investment markets, however, this next economic cycle could be a little while off yet.

All of this uncertainty makes it hard for investors to stay focused and avoid silly mistakes. Uncertainty is magnified by perennial predictions of a crash and then periodically by talk of the next best thing that’s going to make us rich.

Keys to successful investing

It would be nice if the investment world was neat and predictable, but it’s well known for sucking investors in during good times and spitting them out during bad times. If anything, it’s getting harder reflecting a surge in the flow of information and opinion. This has been magnified by social media where everyone is vying for attention and the best way to get this is via headlines of impending crises. This all adds to investor uncertainty and erratic investment decisions.

With all this in mind, we thought it timely to remind our clients of the key investment principles to follow in order to continue to be successful and help weather through this period of high uncertainty.

The nine key things are: make the most of compound interest; don’t get thrown off by the cycle; invest for the long term; diversify; turn down the noise; buy low and sell high; beware of the crowd; focus on investments offering a sustainable cash flow; and objective leadership via your annual progress meeting.

1. Make the most of the power of compound interest

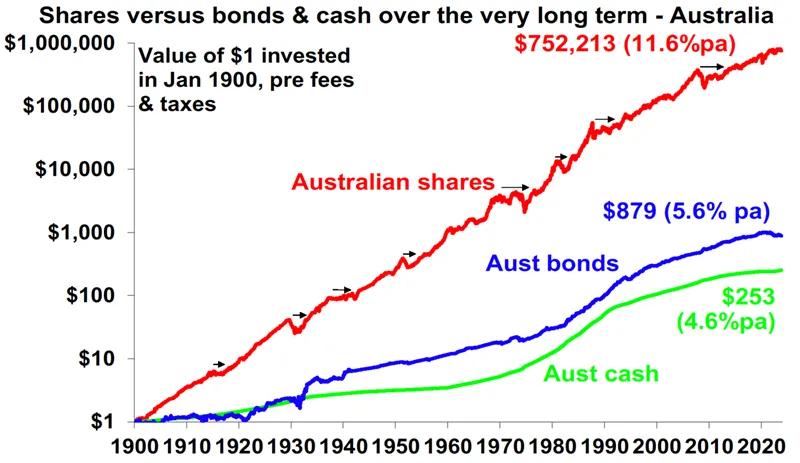

Making the most of compound interest – which refers to the way returns compound on past returns for an investor over long periods - is the most important thing an investor needs to do if they want to build wealth. It works best for growth assets. The next chart shows the value of one dollar invested in 1900 in Australian cash, bonds and equities with interest and dividends reinvested along the way, before fees and taxes.

That one dollar would be worth $253 today if it had been invested in cash. But if it had been invested in bonds it would be worth $879 and if it was allocated to shares it would be worth $752,213. Although the average return on shares (11.6% pa) is just double that on bonds (5.9% pa), the magic of compounding higher returns leads to a substantially higher balance. The same applies to other growth assets like property.

So, the best way to build wealth is to take advantage of the power of compound interest and have a decent exposure to growth assets. Of course, there is no free lunch and the price for higher returns is higher volatility but the impact of compounding returns from growth assets is huge over long periods.

Source: ASX, Bloomberg, RBA, AMP

The volatility set off by the pandemic and now flowing from high inflation and interest rate increases does nothing to change this, any more than previous setbacks (highlighted with arrows) like WW1, the Great Depression, the 1973-74 bear market, the 1987 crash or the GFC did. The likely end of the secular decline in inflation and interest rates over the last few decades which super charged investment returns means average returns over the next decade or so will be somewhat more constrained than we have become used to. But shares offering a dividend yield of 4% (5% or more with franking credits) should still provide superior medium-term returns and hence grow wealth better than bonds where the 10-year yield is 4.50% pa. Unfortunately making the most of the magic of compounding returns can be one of the hardest things to do.

2. Don’t get thrown off by the cycle

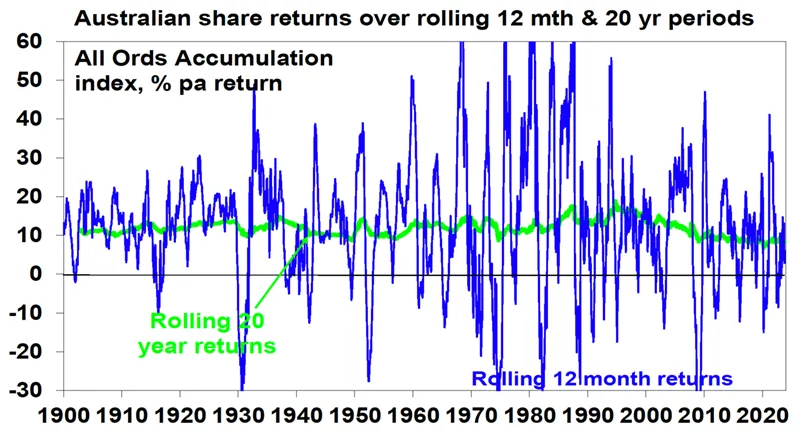

This is often because investment markets go through cyclical swings. All eventually set up their own reversal – eg, as falls make shares cheap and low interest rates help them rebound. But the outcome is extreme volatility in short-term returns as evident in the next chart which shows the pattern of rolling 12 month ended returns in Australian shares (compared to rolling 20 year ended returns).

Source: ASX, Bloomberg, RBA, AMP

The trouble is that cycles can throw investors off a well thought out investment strategy that aims to take advantage of the power of compounding longer-term returns. But cycles also create opportunities. Looked at in a long term context, the 20%

or so plunge in share seen into October last year was just another cyclical swing, after which markets rebounded.

The key is not to get thrown off when markets plunge.

3. Invest for the long term

Looking back, it always looks obvious as to why things happened and dips in investment markets look like great buying opportunities. But looking forward the future is shrouded in uncertainty. And no-one has a perfect crystal ball. As JK Galbraith observed “there are two kinds of forecasters: those who don’t know, and those who don’t know they don’t know.” Usually the grander the forecast the greater the need for scepticism as such calls invariably get the timing wrong or are dead wrong. If getting markets right were easy, then the prognosticators would be mega rich and would have stopped doing it. Related to this many get it wrong by letting blind faith – eg, “there is too much debt” – get in the way of good decisions. They may be right one day, but an investor can lose a lot in the interim. The problem is that it’s not getting easier as the world is getting noisier. This has all been evident through the pandemic and its high inflation aftermath with all sorts of forecasts as to where markets would go, most of which provided little help in actually getting the big swings right. Given the difficulty in getting market moves right in the short-term, for most it’s best to get a long-term plan that suits your level of wealth, age, tolerance of volatility, and stick to it. Focus on the green 20-year return line in the previous chart rather than short term swings.

4. Diversify

Don’t put all your eggs in one basket. Having a well-diversified portfolio will provide a much smoother ride. For example, global and Australian shares provide similar returns over the very long term but go through long periods of relative out and underperformance (eg, Australian shares outperformed in the mining boom years but global shares have outperformed since). Similarly listed assets (like shares) and unlisted assets (like property) often perform differently through the cycle. The key is to have a mix of investments.

5. Turn down the noise

After having worked out a strategy that’s right for you, it’s important to turn down the noise on the information flow and prognosticating babble and stay focussed. The trouble is that the digital world is driving an explosion in information and opinions about economies and investments. But much of this information and opinion is of poor quality.

As “bad news sells” there has always been pressure to put the negative news on the front page of newspapers but there was hopefully some balance in the rest of the paper. In a digital world each story can be tracked via clicks so the pressure to run with sensationalised and often bad news headlines is magnified. This has gone into hyperdrive since the pandemic – with a massively stepped up flow of economic information. This may be of use in providing timely information on how the economy is travelling but it’s also added immensely to the flow of information and often it’s contradictory. The heightened uncertainty is leading to shorter investment horizons which in turn can add to the risk that you could be thrown off well thought out investment strategies.

The key is to turn down the volume on all this noise. This also means keeping your investment strategy relatively simple. So don’t waste too much time on individual shares or funds as it’s your high-level asset allocation that will mainly drive the return and volatility you will get.

Source: Bloomberg, AMP

Here are several tips to help turn down the noise:

- Put the worries in context – there have been plenty of worries over the last century and yet long-term investment returns have been fine.

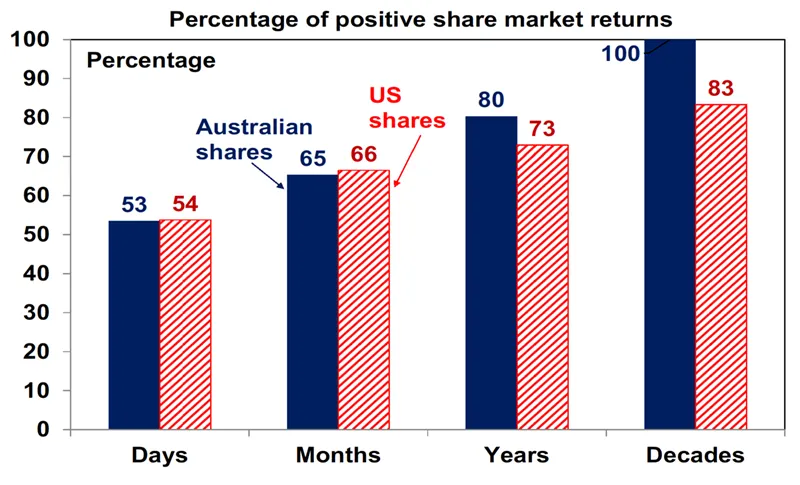

- Recognise it’s normal for markets to swing around in the short term.

- Focus on only a few reliable news services and turn off all “notifications” on your smart device.

- Don’t check your investments so regularly – on a day-to-day basis it’s a coin toss as to whether the share market will rise or fall but the longer you stretch it out between looking at your investments the more likely you will get positive news. See the chart - Percentage of positive share market returns.

6. Buy low, sell high

The cheaper you buy an asset (or the higher its yield), the higher its prospective return will likely be and vice versa, all other things being equal. So as far as possible it makes sense to buy when markets are down and sell when they are up. Unfortunately, many do the opposite, ie, selling after a collapse and buying after a big rally…which just has the effect of destroying wealth even though it might feel good at the time in the midst of a panic (or euphoria). Again, turn down the noise!

7. Beware the crowd at extremes

It often feels safe to be in a crowd and at times the investment crowd can be right. However, at extremes the crowd is invariably wrong – whether it’s at market highs like in the late 1990s tech boom or market lows like in March. The problem with crowds is that eventually everyone who wants to buy in a boom (or sell in a bust) will do so and then the only way is down (or up after crowd panics). As Warren Buffet has said the key is to “be fearful when others are greedy and greedy when others are fearful”.

8. Focus on investments with sustainable cash flow

If it looks dodgy, hard to understand or has to be based on obscure valuation measures then it’s best to stay away. Most cryptocurrency “investments” are a classic example of this. If an investment looks too good to be true it probably is.

By contrast, assets that generate sustainable cash flows (profits, rents, interest) and don’t rely on excessive gearing or financial engineering are more likely to deliver.

9. Annual progress meeting

We are all susceptible to psychological traps like the tendency to over-react to current investment market conditions, or to pay more attention to information and opinion that confirms our own views. The increasing complexity of investing makes avoiding these traps anything but easy. We passionately believe the ongoing yearly progress meeting led by an objective 3rd party council is the key to ensuring our clients stay focused and clear on their unique personal goals and strategies. This meeting and service is absolutely critical to ensuring we can continue to build and protect our clients wealth.

Looking ahead to 2024

In closing, we appreciate your unwavering commitment to your personal plan throughout 2023. Whilst we expect more volatility and uncertainty in 2024 we encourage you to keep these timeless investment principles in mind and we look forward to continued success and meeting with you at your next annual progress meeting.

Merry Christmas and best wishes for 2024

Bill Bracey and the team at Sydney Financial Planning

Does your portfolio need a new strategy for 2024 and beyond?

Arrange a meeting to speak with one of our Financial Planners, either book a virtual meeting or call us to arrange an appointment on 02 4229 8533.

This article was prepared by Dr Shane Oliver with opening and closing summary by William Bracey - CEO & Senior Financial Planner from Sydney Financial Planning. Dr Shane Oliver who provides economic forecasts and analysis of key variables and issues affecting, or likely to affect, all asset markets. He also provides economic forecasts and analysis of key variables and issues affecting, or likely to affect, all asset markets.

Sydney Financial Planning Pty Ltd (ABN 29 606 413 254), trading as Sydney Financial Planning & Illawarra Financial Planning is an Authorised Representative & Credit Representative of Charter Financial Planning Limited, Australian Financial Services Licensee and Australian Credit Licensee.

This article contains information that is general in nature. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information. If you decide to purchase or vary a financial product, your financial adviser, and other companies within the AMP Group may receive fees and other benefits. The fees will be a dollar amount and/or a percentage of either the premium you pay or the value of your investments. Please contact us if you want more information.

If you no longer wish to receive direct marketing from us you may opt out by contacting Sydney Financial Planning . You may still receive direct marketing from AMP as a product issuer, bringing to your attention products, offerings or other information that may be relevant to you. If you no longer wish to receive this information you may opt out by contacting AMP on 1300 157 173.