If you have not fully used your concessional cap in a prior financial year, you may be eligible to use these unused carried forward amounts in a later year.

EOFY Strategies

EOFY Superannuation Strategies

Want to help boost your retirement savings while potentially saving on tax? Here are five smart super strategies to consider before the end of the financial year.

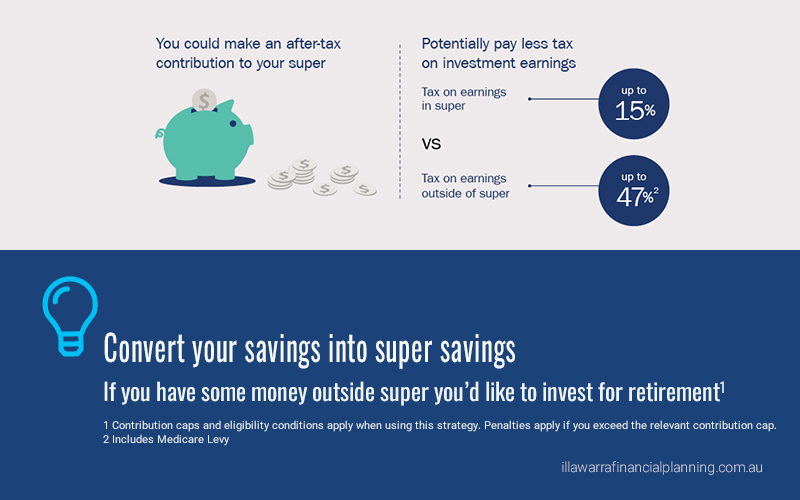

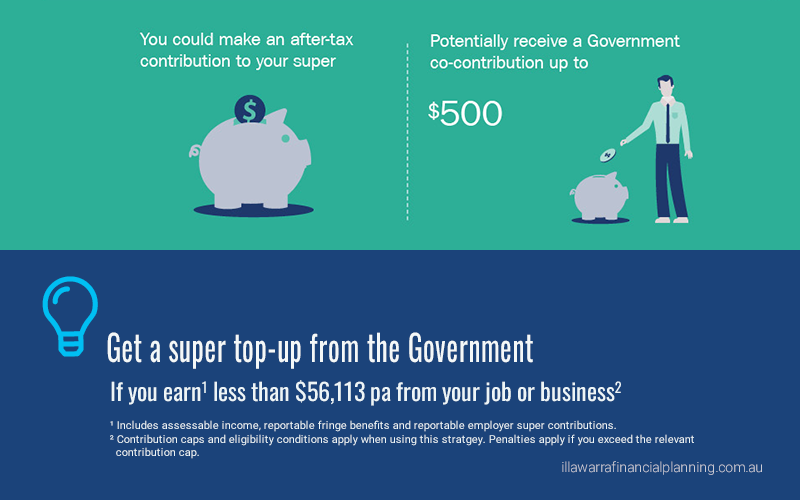

If your income is under a certain threshold, then making personal after-tax super contributions could enable you to qualify for a Government co‑contribution and take advantage of the low tax rate payable in super on investment earnings.

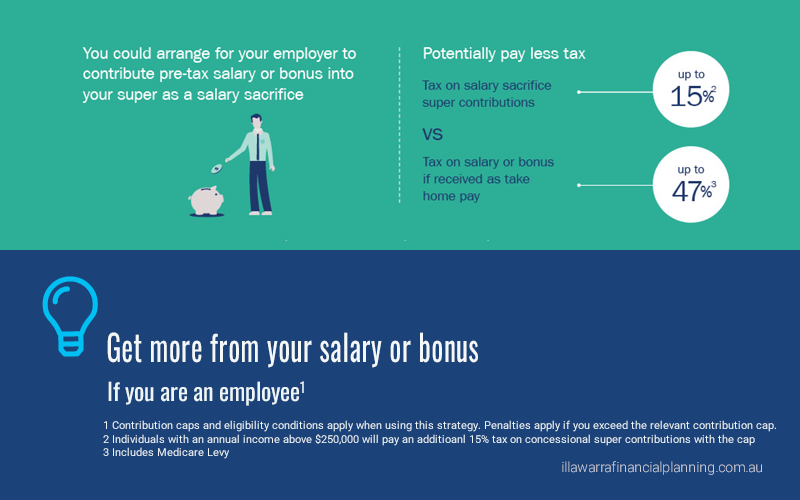

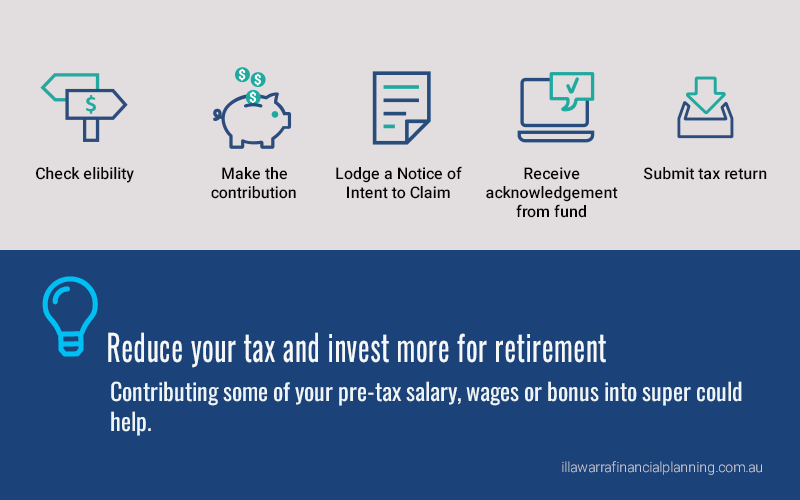

Contributing some of your pre-tax salary, wages or a bonus into super could help you to reduce your tax and invest more for your retirement.

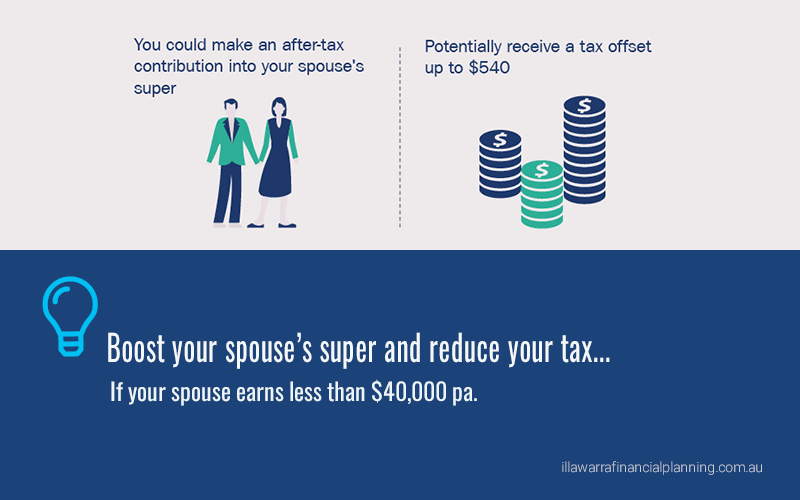

Splitting super contributions to your spouse’s super account may help to boost their retirement savings and provide a range of other benefits.

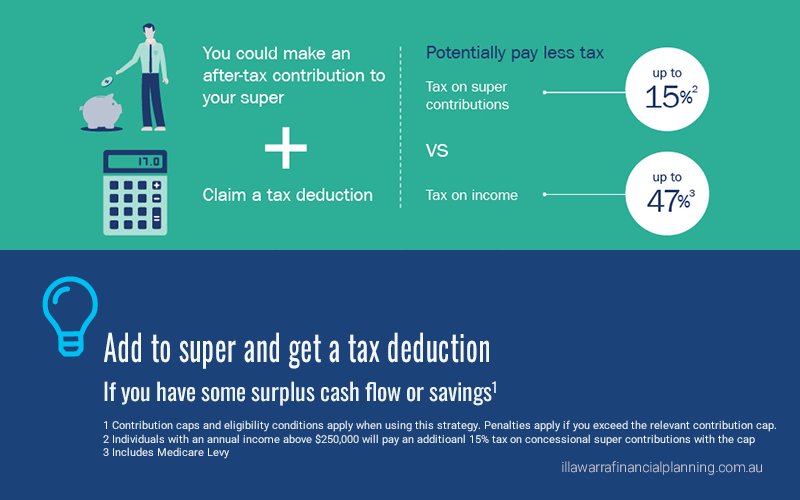

You may be eligible to claim a tax deduction if you make a personal contribution to superannuation. There are some important steps you need to follow carefully and specific timeframes to take action.